Intern – Indirect TAX (KDN)

Hybrid

Wrocław

Check our requirements

- You are available to work 40 hours per week

- You are interested in economics, finance or accounting

- You have strong written and spoken English- language skills (knowledge of an additional language welcome)

- You are an advanced Excel user

- You are a team player at heart. We are looking for someone diligent with strong analytical skills and problem solver mindset

Discover the tasks that are waiting for you

- data extraction from client’s systems

- support in preparation of VAT returns and other indirect tax related reports for multinational clients on a country specific guidance

- support in VAT returns & VAT accounts reconciliations and clean-ups for selected EMEA countries.

- identifying the opportunities for process and technology improvements

- you will report to the team leader and work with him/her as well as the experienced team colleagues

Find out what we have for you

- hybrid work

- extensive training package - benefit from Degreed and LinkedIn Learning platforms, technical training, and Microsoft certified training courses

- buddy support - your mentor will guide you through KPMG

- referral programme - get an extra financial bonus for successfully recommending a friend for a job

- MulitSport card - develop your passions and spend time actively!

- participation in industry events

- trips and team-building events - we will organise and finance the building of team relations

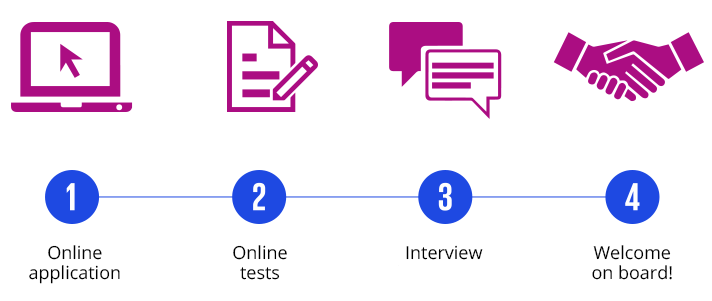

Our recruitment process

Get to know the team better

KPMG Delivery Network is a growing team of experienced VAT experts in the EMEA market. Our main task is to assist clients in fulfilling their VAT reporting obligations. Additionally, we support our clients with tax audits as well as accounting activities.

We are constantly looking for new opportunities to streamline our process, improve its quality and efficiency.

Automation projects using new technologies are waiting for you. By joining our team, we will help you grow by providing a wide range of training available to our employees, both in the field of VAT and many others relevant to the development of your individual career path.

© 2025 KPMG Sp. z o.o., a Polish limited liability company and a member firm of the KPMG global organization of

independent member firms affiliated with KPMG International Limited, a private English company limited by

guarantee. All rights reserved.

PL

PL